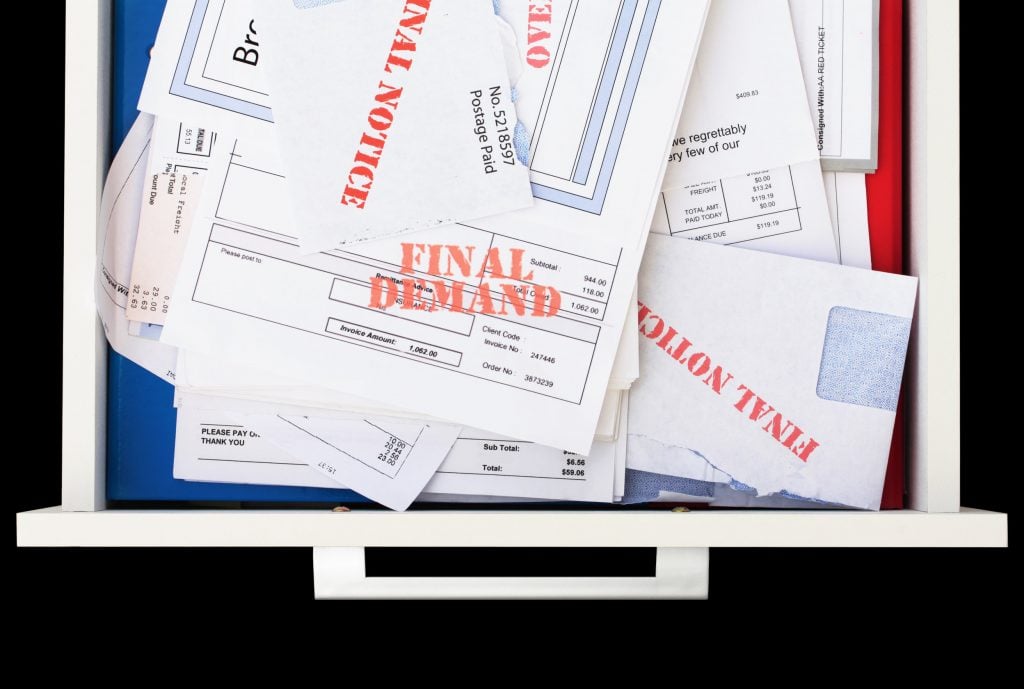

When you’re being harassed by debt collectors on a daily basis, it can feel like there’s no way out. You may receive threatening letters, phone calls at home and at work, or unexpected visits to your residence. Oftentimes, debt collection agencies will do everything in their power to inconvenience or intimidate you when you have an outstanding balance.

Many people are unaware of their consumer rights against debt collectors, including the right to put a stop to many of those harassing phone calls and letters. Find out more about your rights from the Arizona bankruptcy lawyers at Lerner and Rowe Law Group.

The Fair Debt Collection Practices Act (FDCPA)

Consumer rights against debt collectors are upheld by federal law. The Fair Debt Collection Practices Act (FDCPA) was passed in 1977 as an amendment to the Consumer Credit Protection Act and was designed to eradicate abusive debt collection practices. See how this law can protect your interests below.

Note: the following information applies to credit card debt, car loans, medical bills, student loans, and mortgage loans. It does not apply to business debts.

Debt Collectors Must Obey Certain Rules When Trying to Locate You

If a debt collection agency is trying to get in touch with you through another person you’re associated with (such as an employer), they must abide by certain rules. Debt collectors:

- Must identify themselves and state that they are looking for your correct location or contact information. They should not identify their own employer unless expressly requested to do so.

- May not state that the consumer in question has any debt.

- May not communicate with this associated person or party more than once unless they have reason to believe that the information given was incomplete and that said person may now have the correct information.

- Cannot communicate by postcard. In addition, if communicating by mail, they must not include any language or symbols on the envelope indicating that the communication is related to any kind of debt collection.

- If a debt collector discovers that a consumer is being represented by an attorney in connection with their debts, the debt collector must not communicate with any other person other than the consumer’s legal representation (unless their attorney does not respond within a reasonable period of time).

How Debt Collectors Communicate with You Matters

When a debt collector is in direct communication with a consumer, the FDCPA requires that they follow certain rules in respect to how and when they communicate with the consumer. The law also regulates communication with third parties and rules for ceasing communication.

- When communicating with or attempting to reach you, debt collectors cannot do any of the following without your prior consent:

- Contact you at an unusual time or place that is considered inconvenient. This generally includes not contacting consumers before 8:00 a.m. local time or after 9:00 p.m. local time.

- Contact you directly when you have already established legal representation.

- Contact you at your place of employment if your employer prohibits you from receiving outside communications while at work.

- Debt collectors cannot communicate with anyone other than you, your attorney, a consumer reporting agency, the creditor, the attorney of the creditor, or the attorney of the debt collector without your prior consent. The only exceptions to this rule are when the debt collector is given express permission by the courts, or as needed to execute a postjudgment judicial remedy.

- If you notify a debt collection agency in writing that you will not be paying a debt or that you do not wish to receive any further communication from the debt collector, the debt collector must cease all communications with you, with the following exceptions:

- The debt collector can notify you that they will no longer be pursuing collection of your debts.

- The debt collector or creditor can notify you that they can or will be taking specified legal remedies (such as obtaining a judgment) against you.

Debt Collectors Cannot Harass, Abuse, or Oppress You

According to the FDCPA, there are six acts which, if committed by a debt collector or debt collection agency against you, your spouse, your parents (if you are a minor), your executor, or an administrator are considered to be harassment and abuse. Debt collectors:

- Cannot call you without identifying themselves.

- May not use or threaten violence, force, or any other criminal means to harm you, your reputation, or property (or that of any person connected to you).

- Cannot advertise the sale of any debt to coerce you into paying said debt.

- May not use obscene or profane language meant to abuse the recipient.

- Cannot publish a list of consumers who allegedly refuse to pay their debts, except to consumer reporting agencies.

- Cannot call repeatedly or engage in a telephone conversation continuously with the intent to annoy, abuse, or harass someone connected to a consumer debt.

Debt Collectors Cannot Use False or Misleading Information

Anytime a debt collector uses false, deceptive, or misleading information in connection with the attempted collection of a debt, they are in direct violation of the Fair Debt Collection Practices Act. The FDCPA identifies sixteen such misleading practices. Debt collectors cannot:

- Claim that they are affiliated with or bonded by the United States or any U.S. State

- Falsify the character, amount, or legal status of any debt.

- Imply that any communication is from an attorney or impersonate an attorney.

- Claim that the nonpayment of debt will result in arrest, imprisonment, seizure, garnishment, sale of property, etc. unless such action is legal and the debt collector actually intends to take said action.

- Threaten to take any action which either cannot legally be taken or is not intended to be taken.

- Claim that you will lose any claim or defense to payment of a debt or become subject to any other misleading practices once a sale, referral, or other transfer of any interest in a debt occurs.

- Imply or falsely represent that you committed a crime or that you are guilty of disgraceful conduct.

- Communicate or threaten to communicate to any person false or misleading credit information about you. They must also communicate that a debt is disputed if you have indeed disputed it.

- Use or distribute any written communication falsely represented to be authorized or approved by any court, official, or agency of the United States.

- Use any false representation or deceptive means to try to collect on a debt or obtain information about you.

- Fail to disclose to you in any first written or oral communication with you that they are attempting to collect a debt and that they will use any information you give them for that purpose.

- Falsely claim or imply that accounts have been turned over to innocent purchasers for value.

- Falsely claim or imply that documents are part of a legal process.

- Use any business, company, or organization name other than the true and accurate name of the debt collector’s business.

- Falsely claim that legal documents are not legal process forms or that they do not require any action on your part.

- Misrepresent or imply that they operate or are employed by a consumer reporting agency.

Debt Collectors Cannot Engage in Unfair Practices

In addition to misleading information, and harassment, the FDCPA also identifies certain unfair practices. Debt collectors cannot:

- Collect any amount of interest, fees, charges, or expenses incidental to your principal obligation unless the amount was expressly authorized by the agreement from which the debt originated.

- Accept a check or other payment post dated by more than five days unless they notify you that they intend to deposit the check between three and 10 business days before actually depositing it.

- Solicit a post dated check for the purpose of threatening criminal prosecution.

- Deposit or threaten to deposit a post dated check or other payment prior to the date on the check.

- Take or threaten to take nonjudicial action to repossess your property if they have no right to possession of your property as collateral, they have no intention of taking said property, or the property is exempt from repossession.

Debt Collectors Must Give Proper Notice of Debts

Within five days of notifying you that you have outstanding debts, a debt collector must also send you a written notification containing certain information and acknowledgments, including:

- The amount of your debt.

- The name of the creditor to whom the debt is owed.

- A statement acknowledging that the debt will be assumed to be valid unless you dispute the validity of the debt within 30 days of being notified of it.

- A statement that the debt collector will obtain verification of your debt (or a copy of a judgment) should you dispute any part of the debt.

- A statement that the debt collector will provide the name of the original creditor upon receiving a written request from you within 30 days of receiving the notice of debt.

- Debt collectors must cease all collections of a debt upon receiving a written dispute of debt from you or a request for the name of the original creditor.

- A formal pleading from a civil action cannot be used as an initial communication of debt.

- If you do not dispute the validity of a debt, it cannot be construed as an admission of liability in any court.

Additional Consumer Rights Against Debt Collectors

In addition to the requirements set forth in the FDCPA, the state of Arizona has its own regulations relating to debt collection and consumer rights against debt collectors. These are detailed in A.R.S. § 32-1001 to A.R.S. § 32-1057.

Under this law, Arizona requires all collection agencies to be licensed and bonded within the state. Employees of said collection agency must deal openly, fairly, and honestly in all aspects of their business. They are also prohibited from engaging in unfair or misleading practices or attempting any oppressive, vindictive or illegal collections.

This includes actions like imitating judicial processes through written communication, asserting that the collection agency has a legal department or attorney when they do not, trying to collect additional collection fees or court costs you aren’t actually obligated to pay, falsely representing the amount of debt you owe, or falsely stating that its activities are endorsed by the state of Arizona. Violation of Arizona consumer rights laws can result in a class 1 misdemeanor and a civil lawsuit against the debt collector.

How an Arizona Bankruptcy Lawyer Can Help

If you are sick and tired of being hounded by collection agencies and need help getting out of debt, an Arizona bankruptcy lawyer can help you take control of your finances and fight back against unscrupulous debt collectors. Even if you haven’t thought of bankruptcy as an option, an experienced attorney can review your case, advise you of your consumer rights against debt collectors, and make sure you know about all your legal options.

To find out more information, contact Lerner and Rowe Law Group. Our law firm offers free initial consultations to all prospective clients, with no obligation to hire us. Call our office in Phoenix at 602-667-7777 or in Tucson at 520-620-6200. We also have helpful LiveChat agents standing by to answer your questions, or you can request your free case review by filling out this simple form. Our bankruptcy attorneys also offer affordable payment plans to make getting the help you need more accessible.